The Portsmouth Planning Board did something remarkable last week. It ever so slightly loosened its iron grip on a small portion of the city’s iconic downtown. And in the loosening, a lesson fell out.

Local investors want to create at 238 Deer St. a mixed-use building with 21 micro apartments. These units would be no more than 500 square feet and would have no on-site parking.

Though the location is a short walk from the city’s $26 million Foundry Place parking garage—built specifically to facilitate additional commercial activity downtown—the developers needed permission from the Planning Board, in the form of a Conditional Use Permit (CUP), to build those tiny apartments without on-site parking spaces.

A dispute over the need for private parking dragged on for two years, and last week the board voted, despite some member misgivings, to grant the CUP.

That’s a huge decision, for many reasons. Among them, it separates housing from parking not just for this project but possibly for others in the future. Planning boards typically insist on maintaining minimum parking requirements that raise housing costs and occupy real estate that could be turned to more productive uses.

It also allows tiny apartments to fill a huge market need in Portsmouth, where astronomical housing prices are driving away lower-and middle-income people.

During the board meeting, members kept asking about the rental price of the apartments. The developer’s attorney at one point answered, “…it’s going to be market rate, it’s not going to be affordable, that’s really all we can tell you at this point.”

This comment might not sound off to a lot of people, but it would be a strange thing to say about most products.

Why should there be a difference between “market rate” and “affordable?”

We don’t think of most other consumer goods in these terms.

No one says, “the bananas are going to be market rate, not affordable,” or “are you pricing those chainsaws at market rate, or are they ‘affordable?’”

Sure, we browse clearance racks, wait for sales, clip coupons, buy generics or store brands, ransack the corner drugstore in protest of systemic oppression. (OK, maybe you do only some of these things.) But for most consumer goods, we don’t conceive of there being a market price and a separate “affordable” price.

That’s because the market, if allowed to, will provide a gazillion options of most products at a wide range of prices.

If you need toilet paper, the market offers everything from wafer-thin sandpaper to quilted, pillow-soft rolls that smell like a flowering Alpine meadow in spring.

If you need a car, you can pick up a no-frills Nissan Versa (MSRP: $15,700) or save up a little longer and spring for the slightly flashier Bugatti Chiron Super Sport (MRSP: $3.4 million).

If you need a cell phone, you can get a Nokia flip phone for $19 (less than the price of a 12 piece KFC bucket) or a Samsung Galaxy Z Fold 4 for around $1,800.

Sure, housing prices have a range, too. But in housing, government regulations have literally outlawed the construction of many options at the lower end of the range. So builders can’t offer the lower-price fare that manufacturers are able to offer in most other industries.

And so we talk of “market rate” housing and “affordable” housing. That’s not because the market doesn’t want to provide less-expensive options. It’s because governments don’t want the market to provide those options.

As Mark Perry has demonstrated, markets tend to lower prices and improve quality unless government gets in the way. Industries in which government regulations have prevented robust competition (health care, education, housing, child care) have experienced steady price increases, while less regulated industries have experienced price declines.

Remove the regulatory barriers, and the market will be happy to provide micro apartments, tiny homes, duplexes, in-law apartments, single-family homes on half-acre lots and any number of other less-expensive options for people who want them.

Once the supply catches up with demand, “market rate” will become “affordable” in housing just as in most other markets.

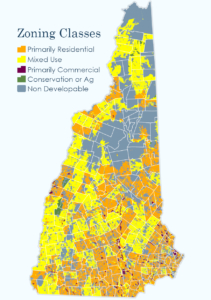

The New Hampshire Zoning Atlas is the most powerful tool Granite Staters have ever had for understanding local zoning ordinances. It catalogues—and maps—23,000 pages of zoning regulations in 2,139 districts in 269 jurisdictions. Never has this information been available in one place, much less open for public examination.

The New Hampshire Zoning Atlas is the most powerful tool Granite Staters have ever had for understanding local zoning ordinances. It catalogues—and maps—23,000 pages of zoning regulations in 2,139 districts in 269 jurisdictions. Never has this information been available in one place, much less open for public examination.