“Our default position should be to try to keep the schools open and get children who are not in school back in school as best as we possibly can.”

— Dr. Anthony Fauci, Dec. 9, 2020

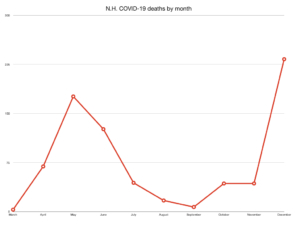

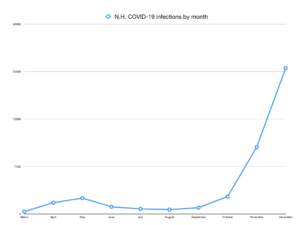

With the 2020-21 school year half over, tensions regarding school reopenings have reached new heights.

In Nashua, frustrated and angry parents are trying to recall school board members who oppose reopening the city’s public schools.

The New Hampshire Education Association has demanded that teachers be classified with “high-risk first responders” and given priority access to limited supplies of COVID-19 vaccines.

News coverage, as usual, focuses on the politics rather than the data.

Stepping back from the drama and looking at the research, it is clear that reopening schools can be done safely, with little risk to students, teachers, staff, or the general public.

In fact, that has been clear since the summer, when researchers at Johns Hopkins University pushed for schools to reopen. Anita Cicero, deputy director of the Johns Hopkins Center for Health Security, said that reopening schools “should be a national priority, and it’s much more important—immeasurably more important—than opening bars or restaurants.”

Regarding the risk to teachers and other school staff:

- The U.S. Occupational Safety and Health Administration puts school personnel in its medium exposure risk category.

- A British Medical Journal study of occupational risk by sector found that workers in the education sector had much lower risk of COVID-19 exposure than health care, medical support, and social care workers, and slightly lower risk than transportation workers. It should be noted that British public schools have mostly been open, unlike American public schools.

- “Teachers had no or only a moderately increased odds of COVID-19,” a Norwegian study of COVID-19 risk by occupation, published in November, found.

- A European Centre for Disease Prevention and Control review of workplace COVID clusters and outbreaks found teachers at low risk, with few incidents at schools.

- An occupational risk tool designed by the Vancouver School of Economics put Canada’s education sector in the medium risk category for COVID-19 exposure.

Regarding COVID-19 transmission in schools generally:

- A Duke University study of North Carolina schools last fall “found extremely limited within-school secondary transmission of SARS-CoV-2” and found that “no instances of child-to- adult transmission of SARS-CoV-2 were reported within schools.”

- An Australian study of COVID-19 transmission in schools found that transmission was “extremely limited” and was lower than for other respiratory diseases.

- A UK study of school reopening found low COVID-19 transmission in schools.

- A study published in Eurosurveillance, the European journal of infectious disease epidemiology, last spring found “no evidence of secondary transmission of COVID-19 from children attending school in Ireland.”

Regarding schools and community spread:

- A Spanish study published in October found “no significant effects of the re-opening of schools” on community infections.

- “The data so far are not indicating that schools are a super spreader site,” University of Michigan infectious disease expert Dr. Preeti Malani said during an Infectious Diseases Society of America briefing in October.

- A University of Washington Center for Education Data & Research study published in December found that school instruction models don’t affect community spread when community infection rates are not high. When community rates are high, in-person instruction with a large percentage of students in school was associated with some additional community spread. The study found that “there is no significant evidence that school systems offering hybrid instruction increases COVID spread.”

The research is increasingly clear that schools can be opened safely when standard precautions are followed.

Importantly, this summary addresses only the risks of COVID-19 exposure, and not the numerous demonstrated negative effects of school closures on student well-being (see here, here, here, here, here, here, and here.)

Given the well-documented negative impact that school closures have had on students, and the low risks associated with reopening, it is evident that getting students back into classrooms ought to be regarded as an urgent need.