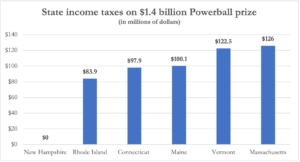

Living in N.H. would save a New England Powerball winner up to $126 million in taxes

If the winner of this week’s $1.4 billion Powerball jackpot lives in any New England state but New Hampshire, the record win would come with a staggering tax bill.

Excluding New Hampshire, which does not tax lottery winnings, the state income tax bill on a $1.4 billion Powerball jackpot would range from $36.8 million–$126 million, depending on where in New England the winner lives and whether he or she took the annuity or lump-sum payment.

The top applicable personal income tax rate for each New England state is:

New Hampshire: 0%*

Rhode Island: 5.99%

Connecticut: 6.99%

Maine: 7.15%

Vermont: 8.75%

Massachusetts: 9%

*New Hampshire levies a tax of 4% on interest & dividends income, but that does not apply to lottery winnings.

At those rates, the state income tax bill on $1.4 billion would be:

New Hampshire at 0% = $0

Rhode Island at 5.99% = $83.9 million

Connecticut at 6.99% = $97.9 million

Maine at 7.15% = $100.1 million

Vermont at 8.75% = $122.5 million

Massachusetts at 9% = $126 million

To put that in perspective, $126 million is not quite double catcher Jason Varitek’s $67 million in lifetime earnings from the Boston Red Sox.

A winner’s actual tax bill would depend on which payout was taken. If a winner chose the annual annuity, the total tax bill would equal the amounts in the graph above, assuming no tax rate changes over the next 30 years. Since we can’t predict any tax changes, we have to go with the current rates.

Those tax bills would come annually based on each year’s annuity payment. Those payments would start at $21.1 million and grow to $86.7 million in the final year. The tax bill after the first year would range from $1.3 million in Rhode Island to $1.9 million in Massachusetts. The final tax bill (barring any tax rate changes over the next 30 years) would range from $5.2 million in Rhode Island to $7.8 million in Massachusetts.

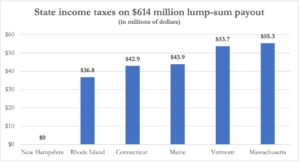

If a winner chose the $614 million lump-sum payment, the state income tax bill would be:

New Hampshire at 0% = $0

Rhode Island at 5.99% = $36.8 million

Connecticut at 6.99% = $42.9 million

Maine at 7.15% = $43.9 million

Vermont at 8.75% = $53.7 million

Massachusetts at 9% = $55.3 million

These huge state tax bills would come after 24% of the prize is automatically withheld in federal taxes. The federal tax bill on $1.4 billion would be $336 million. On the $614 million lump-sum payout, it would be $147.4 million.

These stunning state income tax bills highlight exactly why New Hampshire is one of the top two destinations for people who move out of Massachusetts. (The other is Florida, which also has no income tax.)

New Hampshire is one of only eight participating states and two U.S. territories that don’t tax lottery winnings on top of federal taxes. The others are California, Florida, South Dakota, Tennessee, Texas, Washington, Wyoming, Puerto Rico, and the U.S. Virgin Islands.

The New Hampshire Lottery created a TV ad to air this week mocking Massachusetts’ 9% tax on incomes of $1 million or more. The new ad, spoofing the classic Saturday Night Live “Land Shark” sketch, features a Bay Stater bitten by the “no good Massachusetts tax shark that’s been swimming around stealing all our lottery winnings.”

The ad specifically calls out Massachusetts’ new “millionaire’s tax.” Last year, Massachusetts voters amended the state constitution to raise the income tax rate from 5% to 9% on annual incomes of at least $1 million. Without this millionaire’s surtax, Massachusetts’ tax bill on a $1.4 billion Powerball prize would drop from $126 million to $70 million. On the $614 million lump-sum payment, it would fall from $55.3 million to $30.7 million.

“Why play the lottery in Massachusetts where state taxes, including the new millionaire’s tax, will cost you an extra 9%?” the New Hampshire Lottery’s ad asks Massachusetts residents. “Instead, live free and play in New Hampshire where your income and lottery winnings are always free of state taxes.”

Granite Staters are having a good laugh at the ad, judging by the media coverage it’s received. But the serious point it makes is that you shouldn’t have to pay 9% of your income just for the privilege of living in your home state.

The high income tax rates in other New England states lift significant sums from people’s pockets every year. Vermont’s 8.75% personal income tax rate kicks in at $213,150 of income. Maine’s 7.15% rate kicks in at $58,050. A lot of non-rich New Englanders pay a hefty portion of their income just to live in a state that isn’t New Hampshire.

“It does make one wonder just how much it’s worth paying out-of-pocket to live in a state like Massachusetts,” said Andrew Cline, president of the Josiah Bartlett Center for Public Policy. “Obviously, no one’s getting $126 million worth of services from the State of Massachusetts, so it just comes down to paying for the social status of living there. When you think of how Massachusetts would squander that money, putting up with such an exorbitant tax makes no sense. You’d do more social good by living in New Hampshire and donating $126 million to charity.”

The ad wasn’t meant only to tease Massachusetts, Charlie McIntyre, executive director of the New Hampshire Lottery, said. It also had a message for Granite Staters.

“Our New Hampshire players are fortunate to live—and play—in such an amazing, beautiful state, with an exceptionally high quality of life and of course, no state income tax,” McIntyre said in a statement announcing the ad campaign. “With this new campaign, we are having some fun reminding our players how good they have it, especially when they live free and play—and win!”