New Hampshire is less than a year away from eliminating its income tax.

Maybe.

A bill up for consideration in the House Ways & Means Committee on Tuesday would bring it back.

It’s a myth that New Hampshire has no income tax. The state’s Interest & Dividends Tax is a levy on income derived from dividends or interest. Under current law, this tax expires on Dec. 31 of this year. That would make New Hampshire the eighth U.S. state with no direct tax on personal income.

Joining that elite club won’t happen if the Legislature endorses a plan by state Reps. Susan Almy and Mary Jane Wallner. Their House Bill 1492 would bring the income tax back from the dead.

The current I&D Tax, long set at 5%, was phased down to 3% this year and disappears on Dec. 31. HB 1492 would resurrect it, but with some changes. Instead of exempting the first $2,400 of interest income, as in current law, HB 1492 would exempt the first $7,500. The bill keeps the practice of raising that exemption by 50% for filers who are age 65 or older, blind, or disabled and unable to work.

Almy and Wallner, former chairs of the House Ways & Means and Finance Committees, respectively, seek to address complaints about the impact of the Interest & Dividends Tax by shrinking the pool of people who must pay it.

The argument against repeal has always been that the tax brought in a good bit of revenue and applied primarily to the very wealthy. Ultimately, those were not effective in preventing its repeal. First, surging business tax revenues in the last decade have weakened the case that the state needs the revenue. Second, it was never exactly true that the tax affected only the super rich.

The largest single group of I&D Tax filers are those who owe between $1 and $500. In Fiscal Year 2021, 28,061 Granite Staters (39.4% of the tax’s filers) fell into that category, Department of Revenue Administration data show.

To pay $500 at a tax rate of 5%, one would need to earn $10,000 in interest or dividend income. At current interest rates, that $500 payment would come from someone who was able to sock away $200,000 in a CD or similar interest-bearing account. That’s certainly a tidy sum to have saved, but one does not have to be a millionaire to own an investment of that size.

A $500 payment is the top end of that group. The bottom end is $1, which would be the payment on $20 in interest (after the $2,400 exemption).

Add those who paid between $500-$1,000, and more than half (52.4%) of I&D Tax filers in FY 2021 paid between $1-$1,000 in applicable taxes. Another 23% paid between $1,000-$10,000. That would mean that nearly three-quarters of I&D Tax filers earned between $20-$200,000 in taxable interest income (after exemptions).

Raising the exemptions, as HB 1492 does, will lower the tax bill for some earners and exempt others entirely. It’s unclear how many people would be affected, but it’s safe to assume that a higher percentage of I&D Tax payers would fall into the upper income categories than have in the past.

However, that does not change the fact that many thousands of Granite Staters (and potential Granite Staters) who aren’t super-rich earn interest and dividends income and would see the reinstatement of this tax as a financial threat. People who begin building small sources of investment income hope to grow those into large ones.

Reviving this tax (which is already deceased under current law) would mean literally creating a new income tax and applying it only to a certain class of higher-income residents. Anyone not convinced of this need only read the text of current law, administrative rule and HB 1492.

Current statute (RSA 77:1) refers to the I&D Tax as an “annual tax upon incomes.” The Department of Revenue Administration refers to it as a “tax on interest and dividend income.” HB 1492 refers to it as an “annual tax upon interest and dividend incomes.”

It is unmistakably an income tax, which means that HB 1492 would do in New Hampshire what the Massachusetts millionaire’s tax did in the Bay State in 2022. It would target a specific group of residents with a punitive tax merely because the group is too small to vote out the tax’s supporters and too unpopular to convince a majority to defend it.

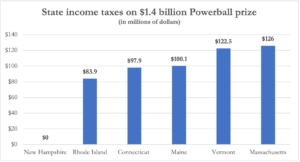

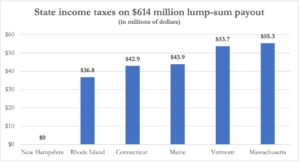

Within months of its passage, the millionaire’s tax was already sending wealthy Massachusetts residents to New Hampshire and Florida. Enacting a similarly punitive income tax targeting these same individuals will have the predictable effect of reducing immigration to New Hampshire and increasing immigration to Florida (from both Massachusetts and New Hampshire).

When the tax vanishes at the end of this year, New Hampshire will be the only state in the Northeast without an income tax. Today the closest one to New England is Tennessee. Under the HB 1492 plan, the Northeast would go back to being the only U.S. region without a no-income-tax state. For New Hampshire’s economic competitiveness, this would be a stumble backward, just as the state is about to stick the long-awaited landing.